نحن هيثم بن طارق سلطان عمان

بعد الاطلاع على النظام الأساسي للدولة،

وعلى المرسوم السلطاني رقم ٤٨ / ٧٦ بشأن توقيع المعاملات المالية الخارجية والداخلية،

وعلى المرسوم السلطاني رقم ٥٠ / ٨٠ بتأسيس شركة تنمية نفط عمان محدودة المسؤولية،

وعلى المرسوم السلطاني رقم ٦٧ / ٢٠٠٣ بتطبيق قانون الجمارك الموحد لدول مجلس التعاون لدول الخليج العربية،

وعلى المرسوم السلطاني رقم ٢ / ٢٠٠٥ بمنح حق امتياز استكشاف واستغلال الهايدروكاربون في مربع (٦) بسلطنة عمان،

وعلى قانون ضريبة الدخل الصادر بالمرسوم السلطاني رقم ٢٨ / ٢٠٠٩،

وعلى قانون النفط والغاز الصادر بالمرسوم السلطاني رقم ٨ / ٢٠١١،

وعلى قانون الشركات التجارية الصادر بالمرسوم السلطاني رقم ١٨ / ٢٠١٩،

وعلى المرسوم السلطاني رقم ١٢٨ / ٢٠٢٠ بتأسيس شركة مساهمة عمانية مقفلة باسم شركة تنمية طاقة عمان (ش.م.ع.م)،

وعلى اتفاقية تمديد وتوحيد اتفاقية حق الامتياز المبرمة بتاريخ ٦ من ذي القعدة ١٤٢٥هـ، الموافق ١٩ من ديسمبر ٢٠٠٤م بين حكومة سلطنة عمان، وشركة برايفت أويل هولدينج عمان المحدودة،

وعلى اتفاقية الشركاء المبرمة بتاريخ ٦ من ذي القعدة ١٤٢٥هـ، الموافق ١٩ من ديسمبر ٢٠٠٤م بين حكومة سلطنة عمان، وشركة تنمية نفط عمان (ش.م.م)، وشركة شل بتروليم كومباني ليمتد وشركة توتال إس إي وشركة بي تي تي أي بي عمان إي اند بي كوربوريشن،

وعلى اتفاقية التشغيل المبرمة بتاريخ ٦ من ذي القعدة ١٤٢٥هـ، الموافق ١٩ من ديسمبر ٢٠٠٤م بين شركة تنمية نفط عمان (ش.م.م) وشركة برايفت أويل هولدينج عمان المحدودة، وحكومة سلطنة عمان،

وعلى العقد المعدل لعقد تأسيس شركة تنمية نفط عمان (ش.م.م) الذي يحكم وينظم علاقة التأسيس بين حكومة سلطنة عمان، وشركة شل بتروليم ليمتد وشركة توتال إس إي وشركة بي تي تي أي بي عمان إي اند بي كوربوريشن بشأن شركة تنمية نفط عمان ش.م.م،

وعلى مجموعة الوثائق التي قامت بموجبها حكومة سلطنة عمان بالتنازل عن كامل حقوقها، والتزاماتها المتصلة بحصة مشاركتها في اتفاقية تمديد وتوحيد اتفاقية حق الامتياز، واتفاقية الشركاء، واتفاقية التشغيل المشار إليها إلى شركة تنمية طاقة عمان (ش.م.ع.م) القابلة لذلك التنازل،

وعلى البروتوكول المالي المتعلق بحصة شركة تنمية طاقة عمان (ش.م.ع.م) في اتفاقية تمديد وتوحيد اتفاقية حق الامتياز،

وبناء على ما تقتضيه المصلحة العامة.

رسمنا بما هو آت

المادة الأولى

إجازة تنازل حكومة سلطنة عمان عن كامل حقوقها، والتزاماتها المتصلة بحصة مشاركتها في اتفاقية تمديد وتوحيد اتفاقية حق الامتياز المشار إليها إلى شركة تنمية طاقة عمان (ش.م.ع.م)، بحيث تصبح الحصص النهائية لأطراف الاتفاقية على النحو الآتي:

(٦٠٪) ستون في المائة لشركة تنمية طاقة عمان (ش.م.ع.م).

(٤٠٪) أربعون في المائة لشركة برايفت أويل هولدينج عمان المحدودة.

المادة الثانية

إجازة تنازل حكومة سلطنة عمان عن كامل حقوقها، والتزاماتها المتصلة بحصتها في اتفاقية الشركاء المشار إليها إلى شركة تنمية طاقة عمان (ش.م.ع.م)، بحيث تصبح الحصص النهائية للشركاء في شركة تنمية نفط عمان (ش.م.م) على النحو الآتي:

(٦٠٪) ستون في المائة لشركة تنمية طاقة عمان (ش.م.ع.م).

(٣٤٪) أربعة وثلاثون في المائة لشركة شل بتروليم كومباني ليمتد.

(٤٪) أربعة في المائة لشركة توتال إس إي.

(٢٪) اثنان في المائة لشركة بي تي تي أي بي عمان إي اند بي كوربوريشن.

المادة الثالثة

إجازة تنازل حكومة سلطنة عمان عن كامل حقوقها، والتزاماتها في اتفاقية التشغيل المشار إليها إلى شركة تنمية طاقة عمان (ش.م.ع.م).

المادة الرابعة

إجازة البروتوكول المالي المشار إليه.

المادة الخامسة

تصبح أي تعديلات مستقبلية للبروتوكول المالي المشار إليه نافذة وفقا لشروطه، وبموافقة الأطراف المعنية.

المادة السادسة

تسري نصوص البروتوكول المالي المشار إليه بغض النظر عن أي أحكام مخالفة في قوانين أو لوائح أو توجيهات سارية في سلطنة عمان.

المادة السابعة

ينشر هذا المرسوم في الجريدة الرسمية، ويعمل به من تاريخ صدوره.

صدر في: ١٢ من رجب سنة ١٤٤٢هـ

الموافق: ٢٤ من فبراير سنة ٢٠٢١م

هيثم بن طارق

سلطان عمان

نشر هذا المرسوم في عدد الجريدة الرسمية رقم (١٣٨١) الصادر في ٢٨ / ٢ / ٢٠٢١م.

Fiscal Protocol in Relation to Energy Development Oman S.A.O.C.’s Participating Interest in the Concession Agreement for Block 6

Preamble

The Government of the Sultanate of Oman has determined that the provisions set out in this Fiscal Protocol shall apply to the Company, in its capacity as a Participant under the Block 6 Concession Agreement. This Fiscal Protocol shall become effective upon ratification by Royal Decree.

The Government intends that this Fiscal Protocol will:

– maintain security of cash flows to the Government from essential national resources;

– allow the Government to benefit from increased returns in periods of higher MOG Prices;

– incentivise the Company to drive financial and operational efficiencies in PDO;

– achieve sustainability and resilience of the Company in periods of lower MOG Prices; and

– allow the Company to continue to invest in operations and activities in order to maximise the value to the Government of the Participating Interest.

The Government has determined as follows.

1 Definitions

1.1 In this Fiscal Protocol, capitalised terms shall have the following meanings:

1.1.1 Additional Royalty has the meaning given to it in Article 4.4.1;

1.1.2 Articles of Association means the articles of association of the Company;

1.1.3 Barrel has the meaning given to it in the Concession Agreement;

1.1.4 Base Royalty has the meaning given to it in Article 4.3.1;

1.1.5 Capital Costs has the meaning given to it in the Concession Agreement;

1.1.6 Change in Law has the meaning given to it in Article 10.1;

1.1.7 Company means Energy Development Oman S.A.O.C. acting only in its capacity as a Participant;

1.1.8 Company Expenditure means all capital expenditure (without depreciation) and

operating expenditure by the Company in a given year in relation to the Participating Interest in accordance with IFRS, except Royalties and the Company’s cost of debt;

1.1.9 Concession Agreement means the Concession Agreement dated 19 December 2004 entered into between the Government and the Participants in relation to Block 6, as amended, modified, restated and consolidated from time to time;

1.1.10 Dividend Policy has the meaning given to it in the Articles of Association;

1.1.11 Dollar, USD or $ means United States dollars, the lawful currency of the United States of America;

1.1.12 Effective Date means the date on which this Fiscal Protocol is ratified by Royal Decree;

1.1.13 Fiscal Protocol means this fiscal protocol;

1.1.14 Forward Sale Agreement means the forward sale agreement between the Seller and Yibal Export B.V. (as buyer) dated 29 June 2016, as amended by an amendment dated 26 September 2018;

1.1.15 FSA Barrels has the meaning given to it in Article 6.1;

1.1.16 Funding Policy has the meaning given to it in the Articles of Association;

1.1.17 Government means the Government of the Sultanate of Oman;

1.1.18 Government Representatives means the Ministry of Finance and the Ministry of Energy and Minerals, acting jointly, for the purposes of this Fiscal Protocol;

1.1.19 International Financial Reporting Standards or IFRS means the accounting and reporting standards issued by the International Accounting Standards Board (IASB) designated as IFRS, those standards issued by the International Accounting Standards Committee designated as International Accounting Standards, their respective interpretations and the framework for the preparation and presentation of financial statements as the same may be amended by the IASB from time to time;

1.1.20 Income Tax has the meaning given to it in Article 5.1;

1.1.21 Income Tax Law means the Oman Income Tax Law promulgated by Royal Decree 28 / 2009, as amended from time to time;

1.1.22 MOG Price has the meaning given to it in the Concession Agreement;

1.1.23 Net Revenue has the meaning given to it in Article 5.2;

1.1.24 OBRDA means the Oman Blend Revenue Distribution Agreement between, inter alia, the Government and Occidental Mukhaizna LLC, dated 11 July 2005.

1.1.25 Operating Costs has the meaning given to it in the Concession Agreement;

1.1.26 Participants has the meaning given to it in the Concession Agreement;

1.1.27 Participating Interest means the Company’s sixty per cent (60%) participating interest in the rights and obligations in and under the Concession Agreement, as defined in Article 4 of the Concession Agreement, derived from the Company’s capacity as a Participant;

1.1.28 Petroleum has the meaning given to it in the Concession Agreement;

1.1.29 Petroleum Delivery Point has the meaning given to it in the Concession Agreement;

1.1.30 Petroleum Operations has the meaning given to it in the Concession Agreement;

1.1.31 Petroleum Revenue has the meaning given to it in Article 4.1;

1.1.32 PDO means Petroleum Development Oman LLC, in its capacity as the operator of

Petroleum Operations;

1.1.33 Project has the meaning given to it in the Concession Agreement;

1.1.34 Royalty or Royalties means the royalties to be paid by the Company to the Government in accordance with this Fiscal Protocol;

1.1.35 Seller means the Government of the Sultanate of Oman, represented by the Ministry of Energy and Minerals (formerly the Ministry of Oil and Gas) in its capacity as seller under the Forward Sale Agreement;

1.1.36 Sole Risk Project has the meaning given to it in the Concession Agreement;

1.1.37 Working Day has the meaning given to it in the Concession Agreement; and

1.1.38 Zero Royalty has the meaning give to it in Article 4.2.

1.2 Unless the context requires otherwise, any reference in this Fiscal Protocol to the following shall have the meaning set forth below:

1.2.1 words referencing the singular shall include the plural, and the plural the singular;

1.2.2 words referencing any gender shall include any other gender;

1.2.3 reference to an Article or Schedule shall be a reference to an article or schedule of this Fiscal Protocol, unless the context indicates otherwise;

1.2.4 a “month”, “monthly”, “calendar quarter”, “quarterly”, “year”, “yearly”, “annual” or “annually” and any other references in time shall be construed by reference to the Gregorian Calendar and any reference to “day” or “daily” shall be construed to mean a calendar day, which shall begin at 00:00 hours and end at 24:00 hours in the Sultanate of Oman (local time);

1.2.5 “person” means an individual, partnership, corporation (including a business trust), company, trust, unincorporated association, joint venture or other entity, whether a body corporate or a non-incorporated association of persons, or any governmental authority;

1.2.6 “third party” means any person other than the Government and the Company;

1.2.7 “including”, “include” or “includes” (or any other inflection of such verb) shall be construed to include the words “without limiting the generality of the foregoing” or “without limitation” or “inter alia”;

1.2.8 the headings of, and arrangement into Articles of this Fiscal Protocol are for convenience of reference only and shall not affect, nor be used in, the construction or interpretation of this Fiscal Protocol; and

1.2.9 references to the Concession Agreement or to any other agreement, document or law (except the Forward Sale Agreement) shall be construed as references to the Concession Agreement, such other documents or law, as amended, varied, novated, supplemented or replaced from time to time.

2 Precedence of laws of the Sultanate of Oman

2.1 This Fiscal Protocol shall become effective upon ratification by Royal Decree and the provisions of this Fiscal Protocol shall apply notwithstanding any provisions to the contrary in the laws, regulations or directives in force in the Sultanate of Oman.

2.2 Subject to the foregoing, the Income Tax Law and other applicable laws, regulations or directives in force shall apply to the Participating Interest, except as otherwise set out in this Fiscal Protocol or the Concession Agreement.

2.3 Nothing in this Fiscal Protocol shall be deemed to amend the Concession Agreement.

3 Application

3.1 As of the Effective Date, this Fiscal Protocol shall apply to the Participating Interest for the duration of the Concession Agreement.

3.2 This Fiscal Protocol shall not apply to any revenue generated from other business activities of the Company.

4 Royalties

4.1 The Company shall pay Royalties to the Government in accordance with this Fiscal Protocol based on the Company’s monthly revenue from the sale by (or on behalf of) the Company of its Participating Interest share of Petroleum. This will be calculated by applying the MOG Price for the nominated month of lifting times the number of Barrels of Petroleum taken by the Company at the Petroleum Delivery Point in such month after deduction of the FSA Barrels (Petroleum Revenue). The Royalties shall consist of:

4.1.1 a Zero Royalty;

4.1.2 a Base Royalty; and

4.1.3 an Additional Royalty,

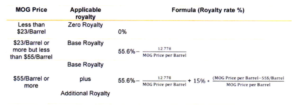

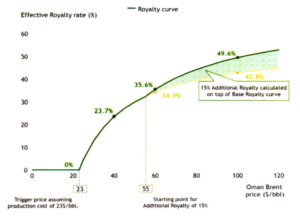

all as set out in this Article 4 and collectively referred to as Royalties. The formulae for each type of royalty are set out at illustration 1 in Schedule 1; with a graphic at illustration 2 and worked examples at illustration 3, all of which are set out for illustrative purposes only.

4.2 Zero Royalty

In any month when the MOG Price is less than twenty-three Dollars (USD 23) per Barrel, the applicable royalty rate shall be zero (Zero Royalty).

4.3 Base Royalty

4.3.1 In any month when the MOG Price is twenty-three Dollars (USD 23) per Barrel or more, a sliding scale royalty rate shall be calculated and paid as a percentage of Petroleum Revenue in accordance with the following formula (Base Royalty):

|

55.6% – |

12.778 _______________ |

|

MOG Price per Barrel |

4.3.2 The Base Royalty sliding scale is linked to the MOG Price, as set out (for illustrative purposes only) in illustration 2 in Schedule 1.

4.4 Additional Royalty

4.4.1 In any month when the MOG Price is fifty-five Dollars (USD 55) per Barrel or more, an additional royalty shall be calculated and paid as a percentage of Petroleum Revenue in accordance with the following formula (Additional Royalty):

|

15% – |

(MOG Price per Barrel – 55$ / Barrel) ________________________________ |

|

MOG Price per Barrel |

4.4.2 The Additional Royalty will be payable in addition to the Base Royalty, as set out (for illustrative purposes only) in illustration 2 in Schedule 1.

4.5 Payment of Royalties

The Base Royalty and Additional Royalty shall be calculated on a monthly basis in arrears by the Company and shall be paid to the Ministry of Finance on a weekly basis upon receipt of the sale proceeds by the Company.

5 Income Tax

5.1 Tax Rate

Subject to Article 5.2, the Company shall pay to the Ministry of Finance tax on its income derived from its activities pursuant to the Concession Agreement in accordance with the Income Tax Law (Income Tax), such Income Tax to be an amount equal to fifty-five per cent (55%) of its income chargeable to tax (taxable income) as defined in the Income Tax Law for that year.

5.2 Taxable Income

The Company’s taxable income, in respect of the Participating Interest only, in any given year for the purposes of this Fiscal Protocol is calculated as follows:

Net Revenue = Revenue (R) minus Cost Recovery (CR); where,

R means the amount calculated as Petroleum Revenue in such year plus other revenues from the sale of Petroleum in such year, if any, including payments received under the OBRDA; and

CR means:

(i) Company Expenditures in such year; and

(ii) Royalties in such year; and

(iii) the Participating Interest share of Operating Costs incurred by PDO in such year; and

(iv) the Participating Interest share of the annual deduction for depreciation (to be applied to Capital Costs incurred by PDO) allowable in such year in accordance with the provisions of Article 8.2 of the Concession Agreement,

excluding, in each case, taxes, duties (other than customs duties funded by the Participants up to a rate of five percent (5%) as described in Article 4.4 of the Concession Agreement), imposts and similar charges paid or payable by the Government, the Participants, PDO and their respective subcontractors directly or indirectly in respect of Petroleum Operations in respect of such year,

less all revenues received by PDO, including, without limitation, revenues received in respect of the evacuation and/or transportation of hydrocarbons owned by third parties and revenues received in respect of the sale or other disposal of assets relating to Petroleum Operations.

5.3 Other Taxes

Subject to Articles 4, 5.1 and 5.2, the Company shall in respect of all income derived from its operations pursuant to the Concession Agreement and of all payments whether by way of dividends or otherwise paid out of such income and in respect of its capital, operations and property be free and exempt during the period of the Concession Agreement from all present and future taxation, imposts and charges whatsoever imposed by the Government.

5.4 Income Tax Law

Save as expressly set out in this Fiscal Protocol, the provisions of the Income Tax Law, including its provisions regarding allowances and deductions, shall apply to the Company’s taxable income in respect of its Net Revenue.

5.5 Payment of Income Taxes

The tax payable under this Article 5 shall be calculated each month in arrears by the Company on a year-to-date basis and shall be paid to the Ministry of Finance, in accordance with a monthly schedule to be proposed by the Company and submitted for approval by the Ministry of Finance.

6 FSA Barrels

6.1 The Company shall, during the term of the Forward Sale Agreement, transfer to the Seller, at no charge, such Barrels of Petroleum as may be required by the Seller in order for the Seller to perform its obligations under the Forward Sale Agreement (the FSA Barrels).

6.2 The Seller shall notify the Company, on a monthly basis, of the number of FSA Barrels required in the following month in order for the Seller to perform its obligations under the Forward Sale Agreement, and the Company shall transfer such FSA Barrels to the Seller in that month, on a “first priority” basis, that is, from the first Barrels of Petroleum to reach the Petroleum Delivery Point in that month.

6.3 The Seller shall (and the Company shall not) have ownership rights to the FSA Barrels, and shall be entitled to dispose of the FSA Barrels pursuant to the terms of the Forward Sale Agreement.

6.4 The Company’s obligation to transfer the FSA Barrels to the Seller shall at all times take priority over all other obligations of, or claims against, the Company.

7 Funding Policy and Dividend Policy

The Dividend Policy and the Funding Policy, together with this Fiscal Protocol, govern the financial arrangements of the Company.

8 Books and Records

8.1 The Company shall (or shall procure that PDO shall) keep and maintain adequate financial accounting books, records and registers concerning the Participating Interest in accordance with IFRS and applicable laws. Original copies of all such financial accounting books, records and registers shall be maintained by the Company (or PDO on behalf of the Company) in the Sultanate of Oman. The Government shall have the right to receive a copy of any such financial accounting books, records and registers, certified by a representative of the Company that it conforms to the original.

8.2 The financial accounting books, records and registers in respect of the Participating Interest shall be kept in Dollars and, in the event that the MOG Price is quoted in another currency, in such other currency.

9 Amendments of the Fiscal Protocol

9.1 Authority to make amendments

9.1.1 The Government shall have the right to amend this Fiscal Protocol in accordance with this Article 9.

9.1.2 Amendments to this Fiscal Protocol may be in respect of either:

(a) any element of the terms of this Fiscal Protocol in general;

(b) specific Project(s); or

(c) Sole Risk Project(s).

9.1.3 Any future amendments to this Fiscal Protocol shall become effective upon approval by the Government Representatives of such amendments. Any such amendments shall not require any further approval or ratification by the promulgation of a Royal Decree.

9.2 Proposed amendments

9.2.1 The Government may, at any point during the term of the Concession Agreement, initiate the process to make an amendment to this Fiscal Protocol.

9.2.2 The Company may at any point during the term of the Concession Agreement, propose to the Government an amendment to this Fiscal Protocol. Any amendment proposed by the Company shall be submitted to the Government in writing and shall include an indication of the benefits of the proposed amendment for the Government and the Company.

9.3 Consultation and determination of proposed amendments

9.3.1 The Government shall, within twenty-eight (28) Working Days from the date of initiating or receiving the proposed amendment (or any such longer period as may be agreed), make a determination in relation to the proposed amendment. The Government may accept, reject, or adjust a proposed amendment.

9.3.2 The Government shall consult with and shall take into account any concerns expressed by the Company before making any determination in respect of a proposed amendment.

9.3.3 If the Government determines that the proposed amendment should be accepted (with or without any adjustments), then this Fiscal Protocol shall be amended in writing to record the proposed amendment. Such amendment shall be signed by the Government Representatives and otherwise approved in accordance with Article 9.1.3 above.

10 Stabilisation

10.1 In the event of a change of Omani tax laws after the Effective Date that directly and materially affects:

(a) the Company’s anticipated economic return in respect of its Participating Interest, as recorded in the Company’s approved strategic plans and budgets; or

(b) the terms of this Fiscal Protocol,

(Change in Law), then the Company may at any time thereafter so notify the Government in writing. Following the effective date of such notice, the Government and the Company shall meet as soon as reasonably practicable to negotiate in good faith and agree upon the modifications which need to be made to the terms of this Fiscal Protocol to restore the economic benefits of the Company to the same level as they would have been had such Change of Law not occurred, or upon such other remedy as they may mutually agree as being appropriate. If the Government and the Company are unable to agree within ninety (90) days after the effective date of the Company’s notice to the Government as to the modifications which are needed to this Fiscal Protocol or such other remedy as may be required, then the Government or the Company may at any time thereafter refer the matter or matters in dispute to dispute resolution to the Ministry of Justice and Legal Affairs pursuant to Royal Decree 88 / 2020.

10.2 The provisions of this Article 10 are intuito personae and solely for the benefit of the Government and the Company, and shall not apply to any third parties or future transferees of the Participating Interest.

IN WITNESS WHEREOF, the Government Representatives have executed this Fiscal Protocol.

By: _________________________

DR. MOHAMMED BIN HAMAD BlN SAIF AL RUMHY

Minister of Energy and Minerals

By: _________________________

SULTAN BIN SALEM BIN SAID AL-HABSI

Minister of Finance

ACKNOWLEDGED, for and of behalf of the Company.

By: _________________________

Name of Signatory: Haifa Al- Khaifi

20 / 1/ 2021

Schedule 1 – Illustration of royalties

illustration 1

The following royalties will be applied at different MOG prices:

illustration 2

The chart below provides an illustration of the progressive royalty curve, including the effective royalty

illustration 3

Set out below are illustrative examples how the royalty calculations would work:

– At MOG Price of $20 / Barrel, Zero Royalty is applied.

– at MOG Price of $40 / Barrel, the Base Royalty is applied, with the sliding scale formula deriving a royalty rate of ~23.7% (calculated as 55.6% – 12.778/40);

– at MOG Price of $60 / Barrel, both the Base Royalty and Additional Royalty are applied, at a combined royalty rate of ~35.6%, derived as ~34.3% from the sliding scale formula (calculated as 55.6% – 12.778/60) plus ~1.3% from the Additional Royalty formula (calculated as 15% * (60-55)/60);

– at MOG Price of $100 / Barrel, both the Base Royalty and Additional Royalty are applied, at a combined royalty rate of ~49.5%, derived as ~42.7% from the sliding scale formula (calculated as 55.6% – 12.778/100) plus ~6.8% from the Additional Royalty formula (calculated as 15% * (100 – 55)/100).

2021/21 21/2021 ٢٠٢١/٢١ ٢١/٢٠٢١